Financial projections for startup companies are incredibly

important for several reasons. You will need financial projections to secure

financing from prospective lenders and investors, as well as to make sure your

business is on the right track.

Comparing actual financial statements with projections

allows you to determine if your business is breaking even, falling short or

surpassing overall goals. As a result you are prepared to make the best

decisions to help your business maintain healthy growth.

DGK has the

experience necessary to create realistic financial projections startup

companies can depend on for guidance and to help secure financing.

How Far Into The Future Should Startup Financial Projections Extend?

A quality financial projection highlights all facets of your

business, including what comes in and what goes out in order to produce

profits.

These projections generally extend three-years into the

future. The goal behind this time frame is to break past the period of losing

money nearly all startups face. In general, start up companies take around

18-months to hit the break-even point. By projecting out three-years you have

the opportunity to forecast actual profit potential.

Two Key Components Of Financial Projections

The two key components all financial projections must include

are sales forecast and an expense budget.

A Sales Forecast

is a projection of sales extending out three-years into the future. In general,

you tally monthly sales for the first year and quarterly sales for the

following year. Important questions to consider when creating sales forecasts include:

How many customers do you expect to obtain in the coming years? How many units

do you plan to sell? What are the costs of goods sold?

An Expense Budget

incorporates both fixed costs and variable costs. Fixed costs include things

like rent, while variable costs include things like marketing. An expense

budget may include general figures as opposed to an exact break down of every

last office supply purchased.

3 Important Documents You’ll Need

Three core documents are required to create a financial projection

statement: income statement, cash flow statement and balance sheet.

Income Statement

shows how much money your business will produce by calculating projected income

and expenses.

Cash Flow Statement

goes into greater detail regarding all income and expenses for your business.

At the end of a given period you total up all income and expenses to see if

your business earned a profit, broke even or lost money.

Balance Sheet

details your business’ overall finances. This includes assets, equity and any

liabilities.

How To Determine Future Sales

Perhaps the most challenging aspect is to determine how much

money your business will be making three years from now. Some helpful tips in

doing so…

- Make use of all market research you originally conducted

when developing your business model and plan. Census data provides keen

insights regarding profits of others in your industry. Industry associations

and publications are also helpful tools to look into.

- If you worked in your industry prior to starting a company

you can use this experience to help create realistic financial projections.

- Get help from an experienced accountant with in-depth

first-hand knowledge regarding small businesses and startups within your

industry. Under the guidance of our

expertise, you’ll have a realistic list of expenses, as well as sales and

profits you can expect to incur under good management.

After creating a first draft, you should go back through and

carefully extract or highlight any and all ‘assumptions’. You could then go

back through in the future and see how these assumptions change and fluctuate

based upon certain factors.

Let Us Help You Create Beneficial Financial Projections

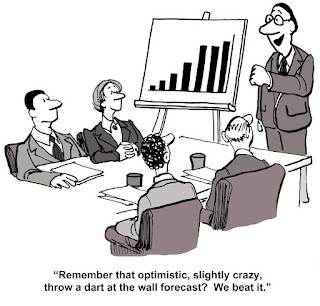

Experienced lenders and investors know that financial

projections are simply estimates and anything can change. That doesn’t mean

financial projections should be unrealistic, on the contrary they should be

conservative and as realistic as possible.

It is not uncommon for a startup company to greatly

overestimate figures, after all your business is your baby and naturally you

have high hopes and expectations. Keep in mind that it’s always better to

supersede expectations than to come up short. Plus, lenders and investors are

trained to be skeptical of inflated projections that sound too good to be true.

Allow our experienced accountants help your startup business

create sound financial projections that benefit you long into the future.