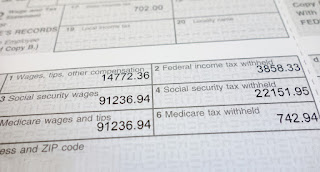

All businesses need to have the

W2s in the hands of their employees by January 31, and are even required by law

to get them out if you happen to be passed the filing date. Even though you

technically don't have to send all of the tax information out until after the

new year, starting to get your W2s ready now can really help start the first

quarter in 2016 off right. Tax season is busy and it doesn't help that it

coincides so close to the holidays when people take off and can easily get

distracted. It can make for hectic times once you realize how close the

deadline sneaks up on you. If you're a business owner, then you may want to

avoid some of the headaches you had last year. Check out some of these tips to

help you stay organized and get some of the work out of the way early.

All businesses need to have the

W2s in the hands of their employees by January 31, and are even required by law

to get them out if you happen to be passed the filing date. Even though you

technically don't have to send all of the tax information out until after the

new year, starting to get your W2s ready now can really help start the first

quarter in 2016 off right. Tax season is busy and it doesn't help that it

coincides so close to the holidays when people take off and can easily get

distracted. It can make for hectic times once you realize how close the

deadline sneaks up on you. If you're a business owner, then you may want to

avoid some of the headaches you had last year. Check out some of these tips to

help you stay organized and get some of the work out of the way early.1. Go Through Your Records

If you have a large company,

then it's easy for things to slip through the cracks. Employees may start and

quit, people take paid time off and unexpected leaves happen too. It's all easy

to forget come tax season. Ensure that you've been keeping meticulous files,

and if not, have someone track down all the forms you need to get the

deductible status, address, social security number, etc of everyone. You can't

guarantee that someone will receive their W2 (wrong forwarding addresses, mail

problems, etc), but you will have to prove that you at least sent it out if

there's a dispute. (Related Reading: Top Reasons Americans Struggle When Filing Their Taxes)

2. Know Your Employees

This is probably going to be

the most tricky part of tax season, because you'll need to know how part-time,

full-time, full-time with benefits and independent contractors will affect your

filings. Typically, you'll set contractors up on W9s but every organization is

different. It makes a huge difference for how the deductions are handled, and

if there's a mistake made then come audit time, you may be in trouble.

3. Talk to Your Staff

It's not uncommon for people to

try to game the system a little during tax time, so give a speech about how

what they do also affects the company. If any of your workers accepted tips,

used company funds for entertaining clients or did anything that doesn't seem

to fall into the given categories, now is the time to give people a chance to

talk about it and clarify. Before you prepare the forms and send them out, they

may be able to bring these situations to your attention to avoid potential

pitfalls.

4. Don't Forget About the Other Documents

Depending on how many employees

you have, it can be a challenging enough task just to get the W2s out. However,

you'll still need to give a lot more information to the government about your

business. It's particularly easy to get something wrong here, and while the

odds aren't likely that one small mistake will be a huge deal (it likely won't

even be caught), there's no reason to take chances.

In the spirit of playing it

safe, it really helps to have a certified accountant on your side through all

this. Finances can get very messy quickly even for small companies that don't

have many employees. Between all the ways a particular expenditure can be

classified and all the extenuating circumstances that can be reported on just

one form alone, it's extremely easy to get something wrong. Trusting someone

else who knows the process and has been through it many times can really save

your company a hassle later on. Not to mention all the time and energy it'll

free up for you to focus on profitability for 2016.